All News

Navigating Market Volatility: Real Assets as a Hedge in 2025

September 8th, 2025

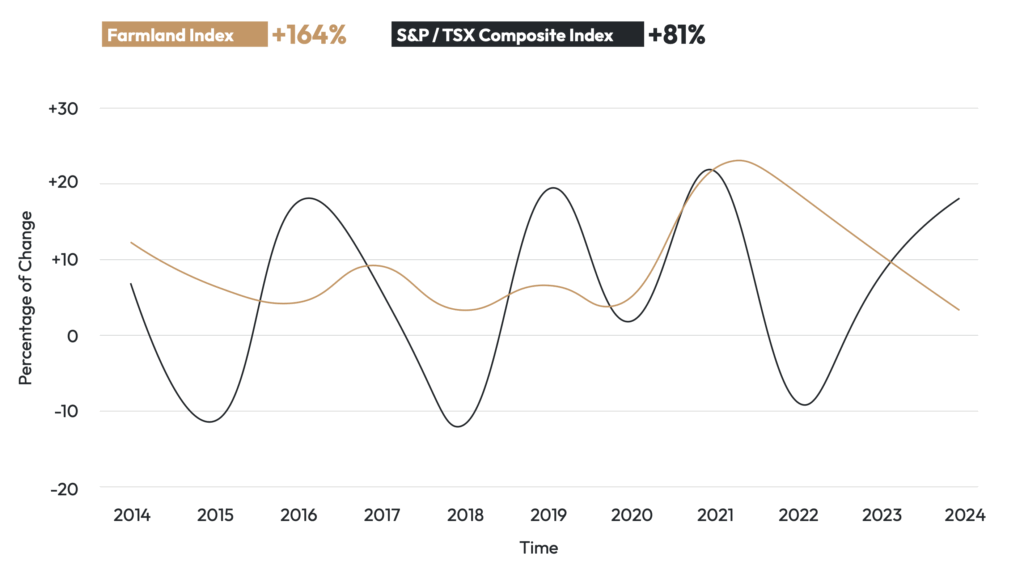

The Canadian investment landscape in 2025 continues to be shaped by uncertainty. Elevated interest rates, ongoing housing affordability challenges, and global economic headwinds are pressuring traditional portfolios of stocks and bonds. In this environment, many investors are turning to real assets — farmland, retail plazas, and development-adjacent land — as a proven hedge against volatility.

Why Market Volatility is Front of Mind

The Bank of Canada’s Financial System Review highlighted three key risks to stability:

High household debt paired with elevated interest rates.

Housing affordability pressures, particularly in urban centres.

Global uncertainty from supply chain shifts and geopolitical factors.

These risks affect traditional assets like equities and fixed income. By contrast, tangible assets such as farmland and community retail centres often remain resilient through market cycles.

Real Assets as a Hedge

Real assets have unique characteristics that make them valuable in volatile markets:

Intrinsic value – farmland and real estate are underpinned by land, not just market sentiment.

Income generation – tenant rents and farm leases provide steady cash flow.

Inflation protection – real estate values and rents often move upward with inflation.

Low correlation – farmland and retail assets tend to move independently from equities and bonds.

Farm Credit Canada’s Farmland Values Report (2024) notes that farmland values increased in 2023 despite broader economic uncertainty, reflecting the resilience of land as a long-term store of value.

Where Farmland Fits

Farmland is increasingly viewed as both a defensive and growth-oriented asset. Defensive because it generates lease income and is essential to food production; growth-oriented because land near urban boundaries often appreciates as cities expand.

Research from Agriculture and Agri-Food Canada reinforces farmland’s dual role in both economic stability and national food security, making it unique among asset classes.

Building Resilient Portfolios

While no investment is immune to economic shifts, real assets continue to demonstrate their ability to hedge against volatility. For investors seeking stability, assets like farmland can provide both cash flow today and growth tomorrow.

As the Bank of Canada and CMHC continue to monitor affordability and housing pressures, real assets will remain central to discussions about how Canadians preserve wealth in uncertain times.

References:

Bank of Canada. Financial System Review, 2024

Farm Credit Canada. Farmland Values Report, 2024

Agriculture and Agri-Food Canada. Food Policy and Farmland Stewardship

Canada Mortgage and Housing Corporation (CMHC). Housing Market Outlook, 2025

This article is for informational purposes only and does not constitute investment advice or an offer to buy or sell securities. Please read our full disclaimer for important details.